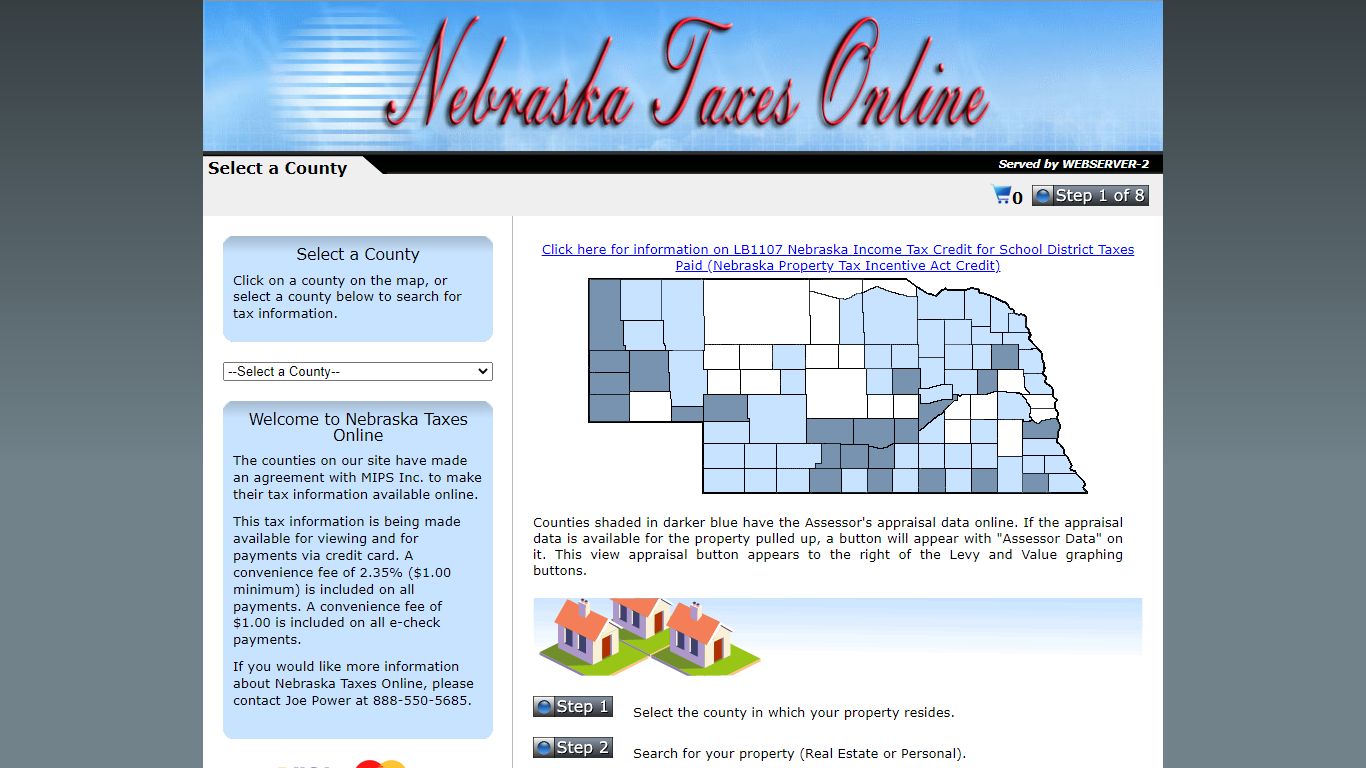

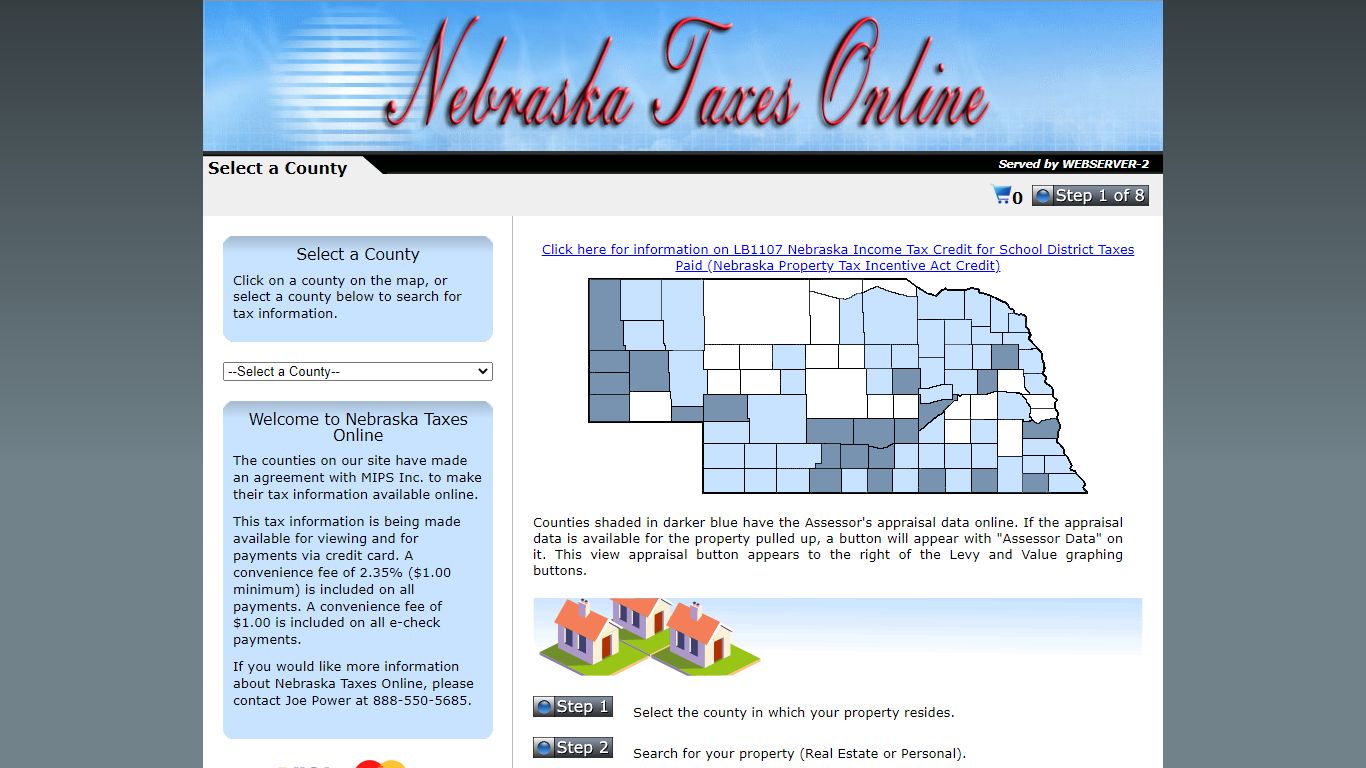

Ne Taxes Online

Nebraska Taxes Online

If you would like more information about Nebraska Taxes Online, please contact Joe Power at 888-550-5685. Not all counties may accept all 4 card types or e-checks. Click here for information on LB1107 Nebraska Income Tax Credit for School District Taxes Paid (Nebraska Property Tax Incentive Act Credit) ...

https://nebraskataxesonline.us/

Nebraska Department of Revenue

Nebraska Higher Blend Tax Credit Act. 7/27/2022. The 2022 Nebraska Legislative Changes are now available. 2022 Nebraska Legislative Changes. 7/27/2022. Check on the status of your refund here: Where's my refund? 6/1/2022. The Nebraska Property Tax Look-up Tool is OPEN, and all 2021 property tax and payment records are available.

https://revenue.nebraska.gov/

Online Filing for Nebraska Business Taxes

Contact. Nebraska Department of Revenue. PO Box 94818. Lincoln, NE 68509-4818. 402-471-5729. 800-742-7474 NE and IA. Contact Us

https://revenue.nebraska.gov/businesses/online-filing-nebraska-business-taxes

Online Services | Nebraska Department of Revenue

Contact. Nebraska Department of Revenue. PO Box 94818. Lincoln, NE 68509-4818. 402-471-5729. 800-742-7474 NE and IA. Contact Us

https://revenue.nebraska.gov/tax-professionals/online-services

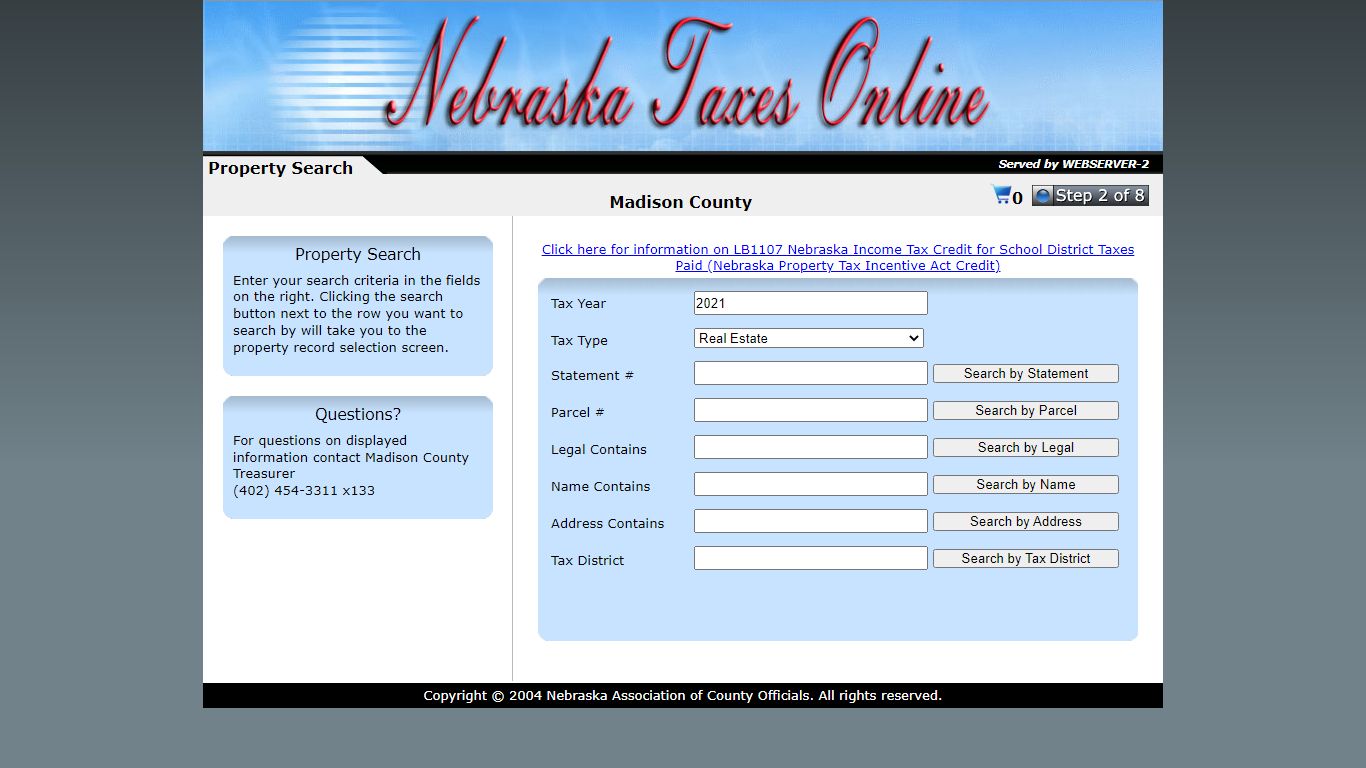

Property Search - Nebraska Taxes Online

Questions? For questions on displayed information contact Madison County Treasurer (402) 454-3311 x133

https://nebraskataxesonline.us/search.aspx?county=Madison

Online Services for Individuals | Nebraska Department of Revenue

Contact. Nebraska Department of Revenue. PO Box 94818. Lincoln, NE 68509-4818. 402-471-5729. 800-742-7474 NE and IA. Contact Us

https://revenue.nebraska.gov/individuals

Nebraska Taxes Online

Net Tax: Balance Due: $ 56,280 $ 876.52 $ 0.00 $ 876.52 $ 0.00: Tax Year: 2003 Statement: 016609: Value: Tax: Exemption: Net Tax: Balance Due: $ 56,280 $ 866.92 $ 0.00 $ 866.92 $ 0.00: The information provided in this site is the most recent and most accurate data available. All information contained herein is for informational purposes only ...

https://nebraskataxesonline.us/audit.aspx?MW6kVBY7OPOI45ICDRNPYiiQdSOQ1LibsT0e03b11/0BMe6/aCIQig==

Nebraska Sales and Use Tax Online Filing

Notice July 2, 2018 If you have a retail location in Nebraska that sells cigarettes and/or roll-your-own tobacco products, click one of the following for important information: Nebraska Cigarette Retailer (replaces July 2017 letter) Nebraska Licensed Cigarette Stamping Agent (replaces July 2017 letter) , Form 10 and Schedules for Amended Returns and Prior Tax Periods Demonstration of Filing ...

https://revenue.nebraska.gov/businesses/nebraska-sales-and-use-tax-online-filing

Individual Income Tax E-filing | Nebraska Department of Revenue

Nebraska Driver's License or State ID for e-filing This filing season, the Nebraska Department of Revenue, along with many other state revenue agencies, is requesting additional information for electronically filed individual income tax returns. This is an effort to combat stolen-identity tax fraud, and to protect you and your tax refund. We ask that you provide the requested Nebraska driver ...

https://revenue.nebraska.gov/individuals/individual-income-tax-e-filing